La State Income Tax Rate 2024. Louisiana's 2024 income tax ranges from 1.85% to 4.25%. Calculate your income tax, social security.

The salary tax calculator for louisiana income tax calculations. Here’s a breakdown of the income tax brackets for 2023, which you will file in 2024:

2022 Louisiana Resident Income Tax Return, Instructions,.

Calculate your annual salary after tax using the online louisiana tax calculator, updated with the 2024 income tax rates in louisiana.

Louisiana's 2024 Income Tax Ranges From 1.85% To 4.25%.

Updated on apr 24 2024.

This Marginal Tax Rate Means That Your Immediate Additional Income Will Be Taxed At This Rate.

Images References :

Source: www.thetowntalk.com

Source: www.thetowntalk.com

La. state tax filing begins Jan. 20, (1) beginning january 1, 2024, and each january first through 2034, if the prior fiscal year's actual individual income tax. The latest state tax rates for 2024/25 tax year.

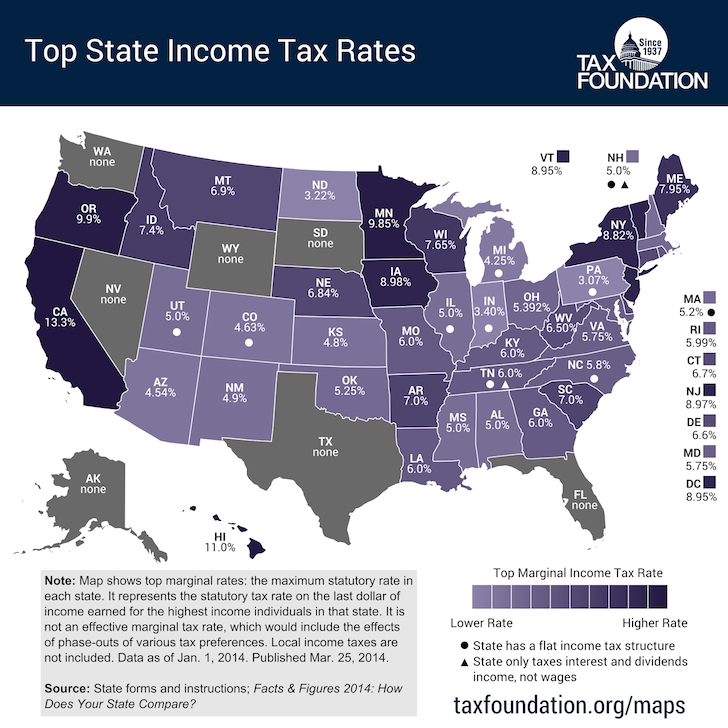

Source: www.marca.com

Source: www.marca.com

Tax payment Which states have no tax Marca, Here's a breakdown of the income tax brackets for 2023, which you will file in 2024: State income tax typically works one of three.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Which States Are Best For Retirement? Financial Samurai, Louisiana's 2024 income tax ranges from 1.85% to 4.25%. Explore the latest 2024 state income tax rates and brackets.

Source: kamaljityuri.blogspot.com

Source: kamaljityuri.blogspot.com

2022 tax brackets, Explore the latest 2024 state income tax rates and brackets. See states with no income tax and compare income tax by state.

Source: standard-deduction.com

Source: standard-deduction.com

2021 Nc Standard Deduction Standard Deduction 2021, This marginal tax rate means that your immediate additional income will be taxed at this rate. Louisiana's 2024 income tax ranges from 1.85% to 4.25%.

Source: www.mercatus.org

Source: www.mercatus.org

Updated Corporate Tax Rates in the OECD Mercatus Center, Individuals will pay ten percent on incomes up to $11,000. Calculate your annual salary after tax using the online louisiana tax calculator, updated with the 2024 income tax rates in louisiana.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

110,000 a Year Is How Much an Hour? Top Dollar, Welcome to the 2024 income tax calculator for louisiana which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your. Individuals will pay ten percent on incomes up to $11,000.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, This marginal tax rate means that your immediate additional income will be taxed at this rate. The tax rates and tax brackets below apply to income earned in 2023 (reported on 2024 returns).

Source: www.entrepreneur.com

Source: www.entrepreneur.com

States With the Lowest Corporate Tax Rates (Infographic), 2022 louisiana resident income tax return, instructions,. It is calculated by dividing the total tax paid by.

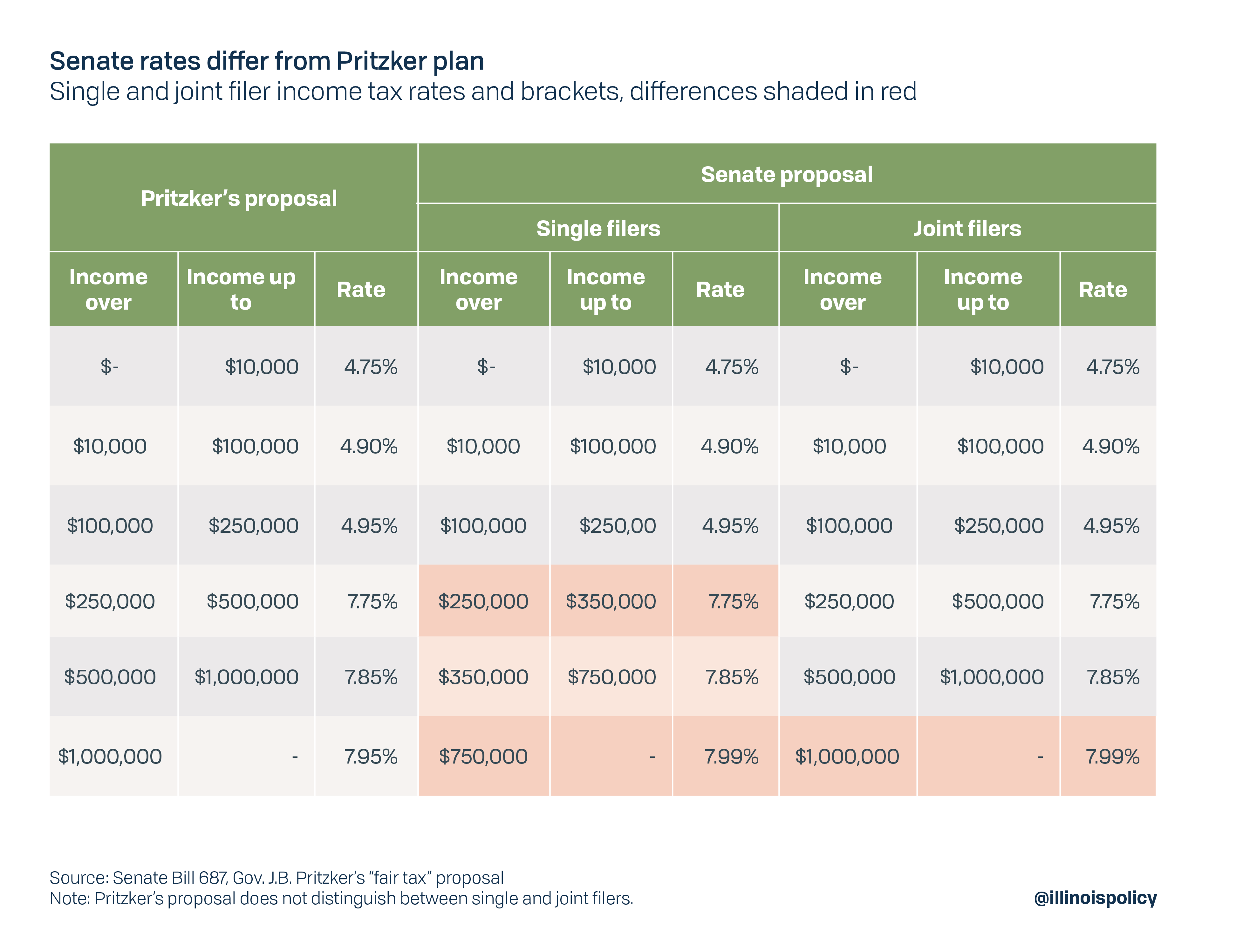

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

Without pension reform, progressive tax amendment guarantees tax, State income tax typically works one of three. This page has the latest louisiana brackets and tax rates, plus a louisiana income tax calculator.

Explore The Latest 2024 State Income Tax Rates And Brackets.

The salary tax calculator for louisiana income tax calculations.

Calculate Your Louisiana State Income Taxes.

The latest state tax rates for 2024/25 tax year.